- Global Expat

- Posts

- The Tax Reconsideration: Moving Abroad and Your Financial Strategy

The Tax Reconsideration: Moving Abroad and Your Financial Strategy

The Tax Reconsideration: Moving Abroad and Your Financial Strategy

The Tax Reconsideration: Moving Abroad and Your Financial Strategy

Moving abroad is an exciting adventure filled with new experiences, cultures, and opportunities. However, one crucial element that needs your attention is your tax situation. When you relocate, your tax obligations can shift dramatically. Here’s why you need to rethink your tax strategy when moving overseas, complete with practical tips and considerations.

Assessing Your Tax Residency

Understanding your tax residency status is the first step in managing your international tax obligations. Your tax residency determines which country can tax your income.

- Tax Residency Criteria: In the United States, citizens and green card holders are taxed on their global income, regardless of their residence. Meanwhile, the UK uses the Statutory Residence Test, which assesses factors like the number of days spent in the UK and personal ties to determine tax residency.

Navigating Double Taxation Agreements

Double taxation—where two countries tax the same income—is a potential pitfall. Thankfully, Double Taxation Agreements (DTAs) can alleviate this issue.

- Double Taxation Relief: For instance, a UK resident working in France benefits from the UK-France DTA, which ensures that the same income isn't taxed twice. Familiarizing yourself with applicable DTAs can prevent unnecessary tax burdens.

Rethinking your tax strategy is crucial when relocating overseas. 🏝️🌍 Understand tax residency, leverage double taxation agreements, use foreign earned income exclusions, and choose tax-friendly destinations. #ExpatLife#OffshoreInvesting#TaxPlanning

— Global Expat ® (@GlobalExpat_)

10:22 AM • Jul 10, 2024

Leveraging Exclusions and Credits

Several countries offer mechanisms to reduce tax burdens for expatriates. The U.S., for instance, provides the Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit (FTC).

- Foreign Earned Income Exclusion: The FEIE allows U.S. citizens to exclude up to $108,700 of foreign-earned income from U.S. taxes in 2024. Additionally, certain housing costs can be excluded or deducted.

- Foreign Tax Credit: The FTC lets you reduce your U.S. tax bill by the amount of foreign taxes paid on income earned abroad, helping to avoid double taxation.

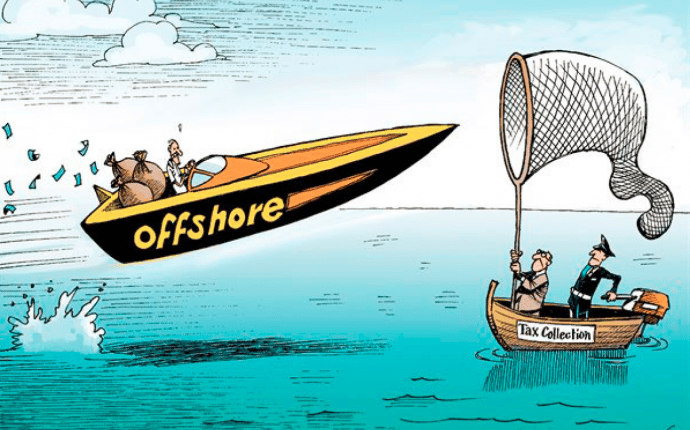

Offshore Tax Planning and Compliance

Offshore tax planning can offer significant benefits but demands strict adherence to international tax laws.

- Reporting Requirements: U.S. citizens must report foreign accounts via the Foreign Bank Account Report (FBAR) and comply with the Foreign Account Tax Compliance Act (FATCA), ensuring all foreign assets and accounts are disclosed to the IRS.

Choosing the Right Tax-Friendly Destination

Your choice of destination can greatly influence your tax liabilities. Some countries offer favorable tax conditions for expatriates.

- Tax-Friendly Countries:

- Panama: Only local income is taxed under its territorial tax system, making it attractive for those earning abroad.

- Portugal: The Non-Habitual Resident (NHR) program offers significant tax advantages, including a flat 20% tax rate on certain income and exemptions on foreign income.

- United Arab Emirates: Known for no personal income tax, the UAE is a preferred choice for expatriates aiming to minimize tax burdens.

Seeking Professional Tax Advice

Given the complexity of international tax laws, consulting with a tax professional who specializes in expatriate taxation is crucial.

- Benefits of Expert Advice: A seasoned tax advisor can help you navigate residency rules, leverage tax treaties, and maximize exclusions and credits, ensuring you save money and remain compliant.

Final Thoughts

Rethinking your tax strategy is vital when you move overseas. By understanding your tax residency status, utilizing DTAs, taking advantage of exclusions and credits, and selecting a tax-friendly destination, you can manage your tax liabilities effectively. Professional advice can further enhance your strategy, ensuring compliance and optimizing benefits.

With careful planning and proactive management, you can enjoy your expat life without unnecessary financial stress. As the expatriate landscape evolves, staying informed and strategic about your tax obligations is key to your success.

---

relocating overseas, expatriate taxation, tax residency, Double Taxation Agreements, Foreign Earned Income Exclusion, offshore tax planning, tax-friendly countries, professional tax advice

Global Expat

📹 Book a video call by the minute using https://app.minnect.com/expert/MohamedAboshanab

💬 Book a consultation: https://Cal.com/globalexpat

📥 Join my Special Mailing list

https://globalexpat.substack.com

👥 Join our community on Locals

https://globalexpat.locals.com/

💻 Join membership: https://www.buymeacoffee.com/globalexpat

🌐 Website: https://Global-Expat.com

📱 Join my community on Telegram: https://t.me/GlobalExpat

👥 Join my Facebook group: https://www.facebook.com/groups/globalexpatofficial

📲 Join my WhatsApp group: https://nas.io/GlobalExpat